The longevity dividend - multivariate risk analysis

Conference

64th ISI World Statistics Congress

Format: CPS Poster

Keywords: "competing risks", longevity, multiple-correspndence-analysius, principal, regression

Session: CPS Posters-04

Monday 17 July 4 p.m. - 5:20 p.m. (Canada/Eastern)

Abstract

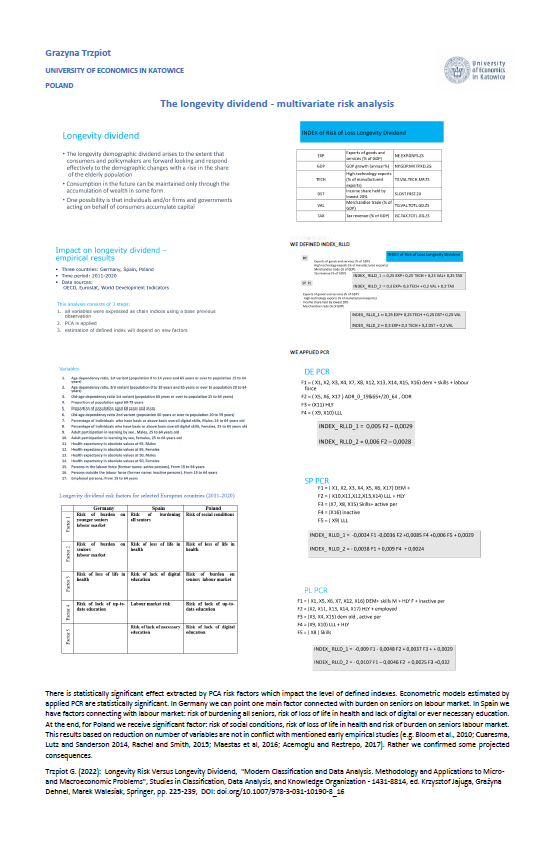

Globally, life expectancy is increasing. Corrected by the Covid -19 pandemics, it is still significantly above the assessments of a few decades ago. Increased longevity in societies means higher spending on pensions, healthcare and long-term care for the elderly. On the other hand, we can create the conditions for a longevity dividend. An older population, a population of young elders, active in the labour market, facing an extended retirement period, often has a strong incentive to accumulate assets and can improve the quality of life of society as a whole. The longevity dividend is the result of the productivity of older adults, which depends on tax incentives, health programmes and pension and disability policies. In the coming years, post-war baby boomers will reach their retirement peak. By continuing to work and remaining socially engaged, the baby boomer generation will change the world, as they have already done many times at different stages of their lives.

The lack of a demographic dividend is a major factor affecting the economics of longevity, and the achievable goal is a longevity dividend. The author will present the results of her own research in the presented area of longevity risk analysis and longevity economics by applying multivariate statistical methods.