Does the Presence of Downstream and Upstream Foreign Direct Investments Affect the Labor Productivity of Domestic Industries?

Conference

64th ISI World Statistics Congress

Format: CPS Paper

Keywords: manufacturing

Session: CPS 73 - Finance and business statistics V

Wednesday 19 July 8:30 a.m. - 9:40 a.m. (Canada/Eastern)

Abstract

With the premise that foreign direct investments (FDI) facilitate

technology and knowledge transfer to domestic industries, eventually contributing

to the country’s sustainable economic development, the Philippine Government

further liberalized its Foreign Investment Act in March 2022 to attract more foreign

investors. However, recent empirical evidence showing that FDI does facilitate

transfer of technology and knowledge and benefit domestic industries remains

limited in the Philippines. This study, based on a balanced panel of industry-level

data of manufacturing firms in the Philippines from 2010 to 2017, examines the

effect of downstream and upstream FDI presence on the labor productivity of the

manufacturing industries in the country. Empirical results suggest that FDI

presence in the downstream industries negatively affects the labor productivity of

domestic suppliers, while FDI presence in the upstream industries does not

significantly affect the labor productivity of domestic final-goods producers.

To reap the positive productivity benefits from FDI, the findings of this study

recommend the development of policies and programs to raise the absorptive

capacities of domestic industries, upgrade the local quality standards of the

domestic suppliers, and strengthen the collaboration between foreign suppliers in

the local market and domestic final-goods producers.

Figures/Tables

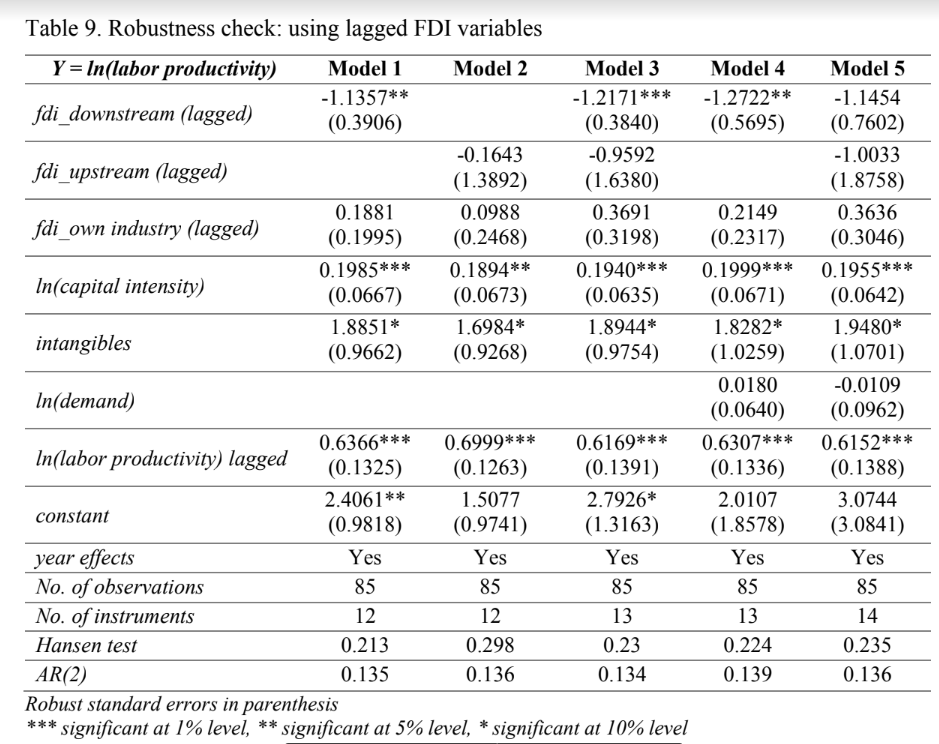

labor productivity

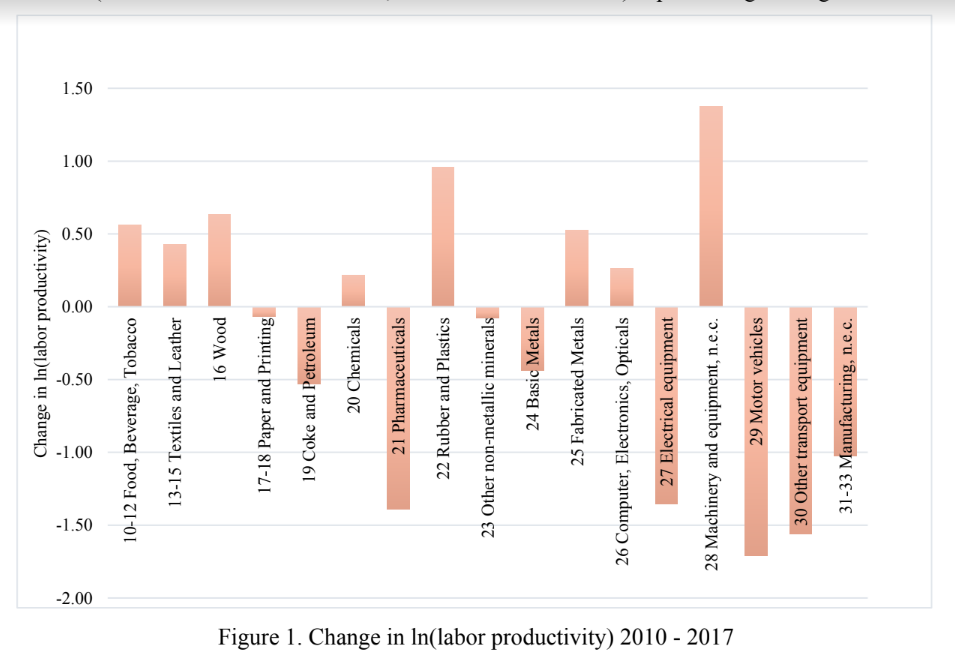

foreign firms

downstream FDI

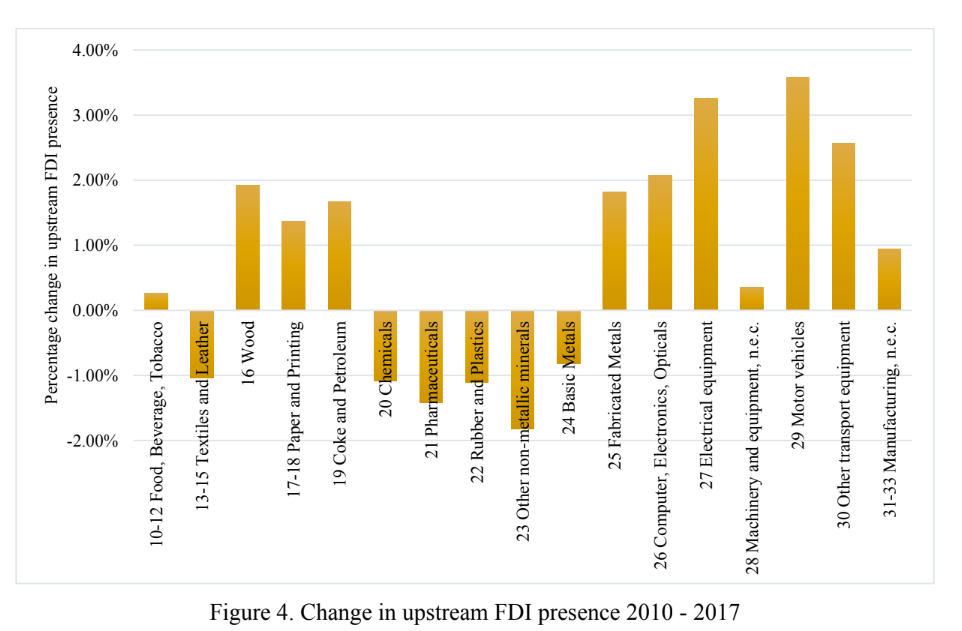

upstream FDI

results

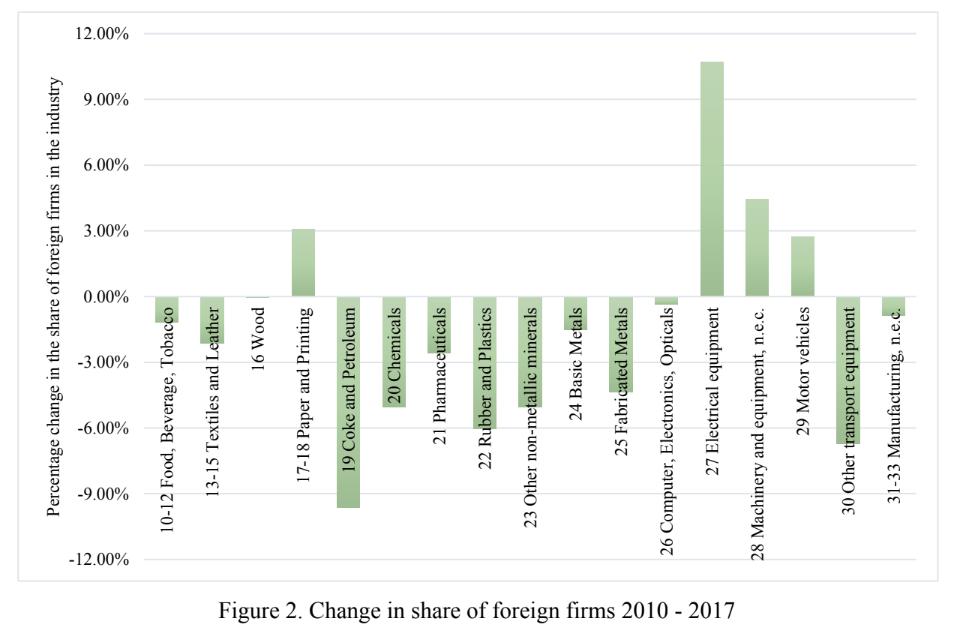

robustness check