PB35-Monetary Conditions Index: A Monetary Policy Indicator for Nigeria

Conference

65th ISI World Statistics Congress

Format: CPS Poster - WSC 2025

Keywords: monetary conditions index, monetarypolicy

Session: CPS Posters 04

Monday 6 October 4 p.m. - 5 p.m. (Europe/Amsterdam)

Abstract

Monetary and price stability remains one of the core monetary policy objectives, which has informed monetary policy decisions over the years. The effectiveness of the transmission mechanism of monetary policy in several economies has been a source of concern. A proper assessment of the monetary conditions is critical to aid monetary authority in adjusting the policy rate or money supply level required to stabilize the economy. Thus, having an indicator that enables a quick assessment of the current state of monetary conditions is critical for effective policy decisions, and it would be a key element for macro-prudential policymaking. The Monetary Conditions Index has gained prominence as a useful indicator for assessing the overall health and tightness or otherwise of a country’s monetary policy.

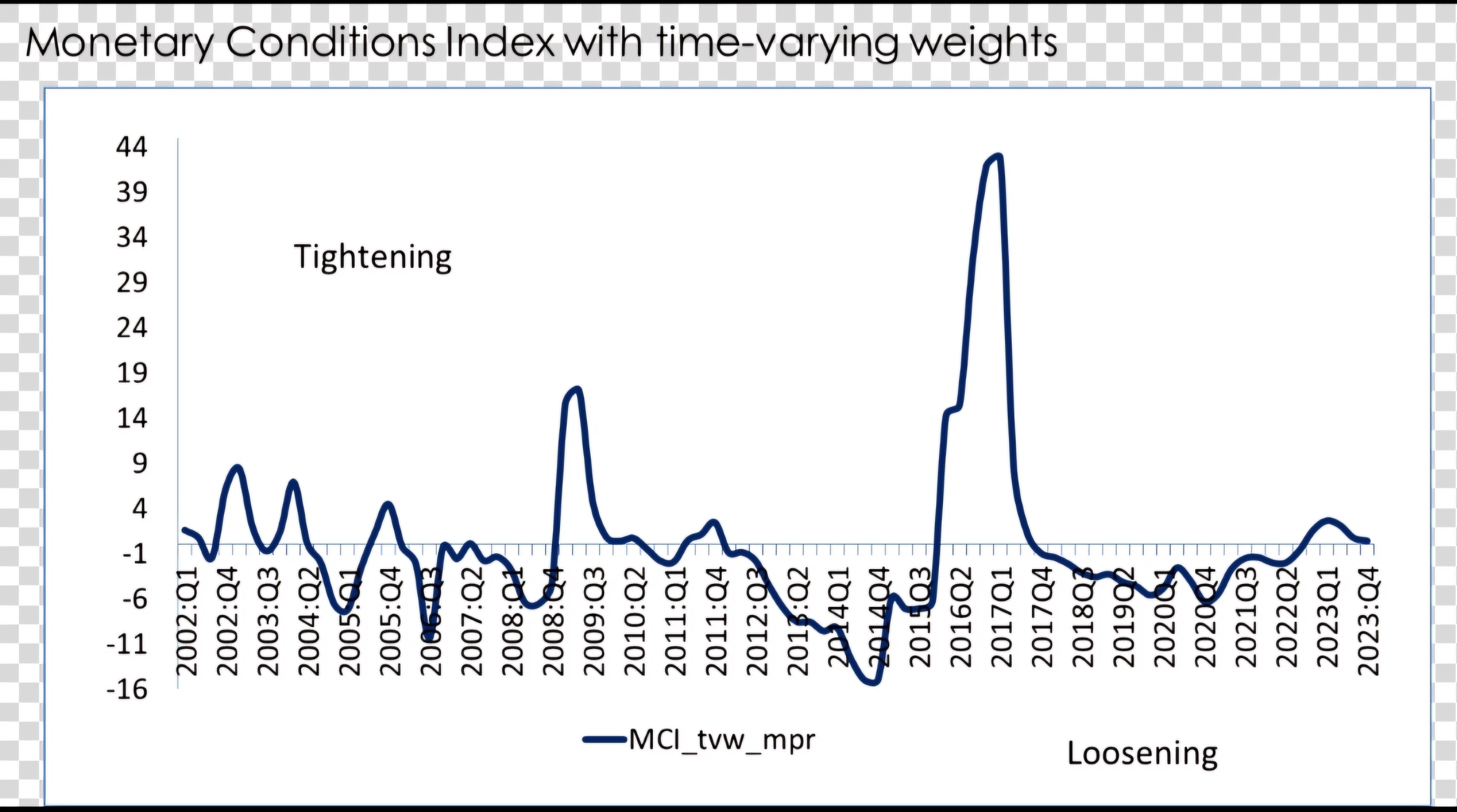

The paper used principal component analysis, to construct a Monetary Conditions Index (MCI) for Nigeria to adequately ascertain the level of monetary policy intervention required for curtailing inflationary pressure and provide an additional toolkit for informed monetary policy decisions toward the attainment of desired economic outcomes. The overall result indicates a descent from predominantly tight monetary conditions in the global financial Crisis (GFC) of 2008 to a largely loose stance post-2008, except for the period 2016-2017. Policy reactions in the wake of the COVID-19 pandemic partly explained Nigeria’s loose monetary conditions during the period and part of 2023. However, the dynamics of Nigeria’s MCI significantly trended towards a tight stance in 2023Q3, though remaining loose afterward.

Introducing time-varying weights for the real exchange and interest rate gaps, resulted in a better approximation of the dynamic economic conditions, thus, providing more information about the policy stance. The results show that Nigeria experienced loose monetary conditions in some years due partly to negative real interest rates. However, sustained policy rate hikes by the monetary authorities made the monetary condition less loose in subsequent periods.

Figures/Tables

1000407112